FAST, EASY & INEXPENSIVE

Do you know the difference between a $7,500

Surety Bond and Errors & Omissions Insurance?

THE PROFESSIONAL FLORIDA NOTARY PUBLIC APPOINTMENT COMPANY

© 2025 All Rights Reserved Aaron Notary Appointment Services Inc.

P.O. Box 693002 Miami FL 33269-3002

Phone: (305) 654-8887 or 800 350-5161 | Español: (305) 903-2388

Fax: (305) 493-3339

Contact Us | Refund/Cancellation Policy/Terms and Conditions

CONNECT WITH US

* What is a Surety Bond? The bond does not protect the notary. The

bond is designed to protect the public against any act of

misconduct or negligence in the performance of your official duties

as a notary public. It does not protect you. In fact, when a notary

bond is paid to some individual who was harmed as a result of an

improper notarization, the bonding company will usually demand

repayment from the notary. For your protection, you may want to

carry Errors and Omissions Insurance.

* What is Errors and Omissions Insurance? Errors and Omissions

Insurance (commonly called E&O) is a form of liability insurance that

protects the notary public from claims or suits that are the result of

the notary’s negligent acts, errors and omissions. Much like car

insurance, this type of insurance covers: investigation, defense and

settlement of committed or alleged acts by the insured notary

public subject to policy limits and provisions.

Protect yourself with personal liability insurance.

Can you afford the high cost of a lawsuit?

The State required $7,500 bond protects the public, not you.

The Bonding Company will seek reimbursement from you even

if you are wrongfully sued.

Aaron Notary Appointment Services, Inc. highly recommends

that you protect yourself against these high costs with an E&O

policy (personal liability coverage).

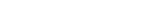

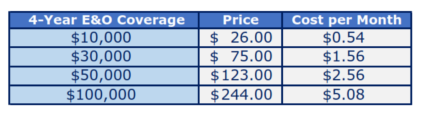

Aaron Notary has the following coverage options for your

convenience:

If you already has been appointed as a Notary Public and would

like to add E&O Insurance. Please call us to provide you with a

Quote.

Notary Bonds and E&O Insurance policies are underwritten by RLI

Insurance Co. and Contractors Bonding and Insurance Co. a A+

Rated by A.M. Best

Aaron Notary has the following coverage options for your convenience:

If you already has been appointed as a Notary Public and would like to add E&O Insurance. Please call us to provide you with a Quote.

Do you know the difference between a $7,500 Surety Bond and

Errors & Omissions Insurance?

* What is a Surety Bond? The bond does not protect the notary. The bond is designed to protect the

public against any act of misconduct or negligence in the performance of your official duties as a

notary public. It does not protect you. In fact, when a notary bond is paid to some individual who was

harmed as a result of an improper notarization, the bonding company will usually demand repayment

from the notary. For your protection, you may want to carry Errors and Omissions Insurance.

* What is Errors and Omissions Insurance? Errors and Omissions Insurance (commonly called E&O) is a

form of liability insurance that protects the notary public from claims or suits that are the result of the

notary’s negligent acts, errors and omissions. Much like car insurance, this type of insurance covers:

investigation, defense and settlement of committed or alleged acts by the insured notary public

subject to policy limits and provisions.

THE PROFESSIONAL FLORIDA NOTARY PUBLIC APPOINTMENT COMPANY

© 2025 All Rights Reserved Aaron Notary Appointment Services Inc.

P.O. Box 693002 Miami FL 33269-3002 | Phone: (305) 654-8887 or 800 350-5161 | Español: (305) 903-2388

Fax: (305) 493-3339 | Contact Us | Refund/Cancellation Policy/Terms and Conditions

Notary Bonds and E&O

Insurance policies are

underwritten by RLI Insurance

Co. and Contractors Bonding

and Insurance Co. a A+ Rated

by A.M. Best

FAST, EASY & INEXPENSIVE

CONNECT WITH US

Protect yourself with personal liability insurance.

Can you afford the high cost of a lawsuit?

The State required $7,500 bond protects the public, not you. The Bonding Company will seek reimbursement from you even if you are

wrongfully sued.

Aaron Notary Appointment Services, Inc. highly recommends that you protect yourself against these high costs with an E&O policy

(personal liability coverage).

Notary Bonds and E&O Insurance policies are underwritten by RLI Insurance Co. and Contractors

Bonding and Insurance Co. a A+ Rated by A.M. Best